IBMC Financial Professionals Group, an internationally recognised financial services institution and business consultants, has joined hands with US Gold Currency and Blockfills to bring the world’s first monetary gold-backed digital gold currency to the Gulf Cooperation Council (GCC), Middle East and Africa (MEA).

The currency is also being simultaneously introduced in India.

For this, IBMC has partnered exclusively with US Gold Currency Inc, the issuer of the US Gold digital currency, and Blockfills, the transaction platform provider.

Each US Gold digital currency is backed by US American Eagle one ounce (33.931 gram) gold coin, minted by US Federal Agency, US Mint. The holders of the currency can redeem their digital assets as physical gold coin or in US dollars anywhere in the world.

IBMC is introducing the digital asset to customers ranging from retail and corporate investors, banks, financial institutions and sovereign wealth funds to treasuries and asset management companies.

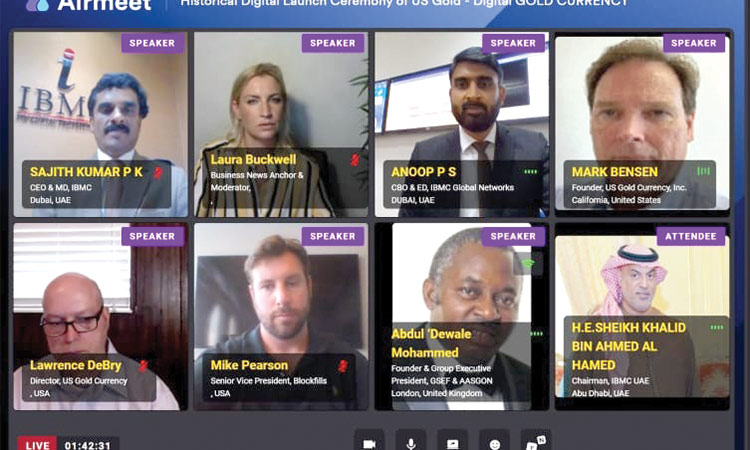

The US Gold digital currency was launched on June 22 from Dubai at a specially designed IBMC Hybrid Event by Sheikh Khalid Bin Ahmed Al Hamed, Chairman of IBMC Financial Professionals Group and Sajith Kumar PK, CEO & Managing Director of IBMC Financial Professionals Group, with the virtual presence of officials from the US Gold Currency, Asia-Africa Development Council, GSEF and Blockfills USA.

“We have seen significant demand for gold and USG is an innovative and unique digital currency backed by the American Eagle one ounce gold coin. Today’s global economic climate has further increased that demand at the institutional and retail levels. We are very happy to join hands with US Gold Currency and Blockfills in bringing the world’s first monetary gold-backed digital gold asset to the GCC, Middle East and African markets in addition to India,” said Sheikh Khalid Bin Ahmed Al Hamed.

Consumers and businesses benefit from a secure digital asset token that is not subject to the volatile swings of the markets, and from the opportunity to easily exchange their digital currency into a tangible asset, monetary gold coins produced by the US Mint.

With the launch of the digital gold currency, investors in GCC, Middle East & Africa will have the significant opportunity to reduce the cost of their transactions as well as have the flexibility of time for making payments. A customer can login with a secured user ID and password on the trading platform for buying and redeeming the coins.

“Tackling the adverse economic effects of the COVID-19 pandemic, the launch of the Digital Gold Currency will enable companies in developing countries settle their inter-company transactions without paying extortionate fees,” said Dr Abdul Dewale Mohammed, Deputy Director General, Asia-Africa Development Council. As a vital transport currency, it will to a large extent help reduce and eliminate risks in business, he added.

Larry Debry, Director US Gold Currency, said: “We are honored to be working with the leaders of IBMC and their esteemed team of professionals. Gold has been one of the most significant legacy asset classes throughout history. Just as everyone has written gold off, saying it is outdated and no longer relevant, US Gold Currency created the USG forming a futuristic and modern gold asset class for the 21st Century by marrying monetary gold with the Blockchain. USG is the ‘real’ digital gold”.

Each USGold token (USG) is backed 1:1 with an underlying physical gold coin, the US American Eagle, which is created and distributed by the US Mint. Therefore, USG token holders can redeem their tokens physically for gold coins, should they choose to forego the digital asset in their wallet. Token holders can also sell the USG on the open market through various digital asset exchanges or through Blockfills in exchange for US Dollars. USG can also be converted into several other digital assets, including BTC, ETH, USDT and more.

The US government division, the US Mint, sets the price of the underlying physical gold coin once per week, on Wednesdays. USG pricing follows this publicly available government set price.

“IBMC Financial Professionals Group is always committed to introducing innovative and credible services to the investing public. USG is easy to handle without customs barriers, easy to hold without any country restrictions, paying insurance cost or storage charges. USG is US regulated and fully online with easy account opening and operating procedures, enabling customers to avail all services of USG from their homes or office, which of course is an added advantage in the current and post COVID-19 pandemic period,” said Sajith Kumar PK, CEO & Managing Director, IBMC Financial Professionals Group.